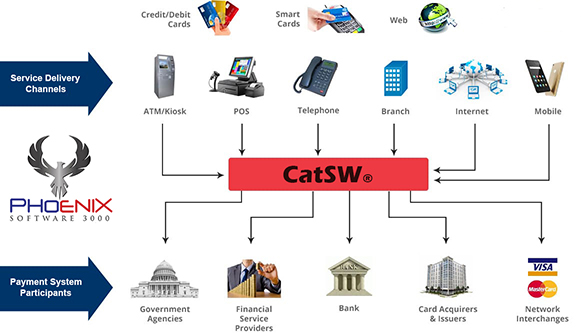

The transactional Switch CatSW® is a functional, flexible, multi-company and multi-currency (EFT) system that enables financial institutions to acquire, authenticate, switch and authorize large volumes of financial transactions through multiple channels, thereby increasing revenues from service fees, providing payment services to customers, reducing operational costs, managing risk, etc.

This solution has the ability to provide your customers the possibility of making electronic transactions by ATM, POS, payment kiosks, mobile devices, IVR systems and Web services. CatSW® interprets the rules of business to perform routing, denials, flows of transactions, segmentation of traffic; can create connection nodes dynamically to any network (issuers, acquirers), i.e., all the communications are performed through ISO8583 messaging configured via parameters.

Also establishes connection to the domestic and international networks (Suiche 7B, Consorcio Credicard, Conexus, MasterCard, Visa), generates — for settlement processes — the reconciliation of transactions with each of the entities involved in the network, handles all elements of security: encryption according to PCI standards, connections to HSM security devices (Thales, Atalla, Futurex, IBM cryptographic cards), generation of random keys with HSM security devices (Dynamic keys exchange), etc.

The added values of CatSW®:

It is a completely modular and configurable system according to the client's needs, allowing to add functionalities over time and thus avoiding high acquisition costs.

It is fully compliant with Debit Mastercard®.

Handles Contactless transactions.

Leverages the high characteristics of the IBM i platform for IBM Power Systems for performance, fault tolerance and security.

Leverages the native DB2 database of the IBM i platform to avoid purchasing additional hardware and software licenses for the database (Oracle, Microsoft SQL).

Leverages the native encryption hardware of the IBM Power Systems (Cryptographic card 4767) to avoid the costs of acquisition and maintenance of HSM devices (Thales, Atalla, Futurex, etc.).

The CatSW® modules:

CatSW® Core: Main and essential module to enable the coexistence of the other modules.

CatSW® Conex: Allows interconnection with the different nodes of the network, applies the different messaging modes related to the network node connected

to CatSW®. It adapts to the business rules established according to the acquiring device, whether ATM, POS, mobile devices, HTTP services, API, etc.CatSW® Routing: Manages transactional routing, controls messaging flow, and validates that sent and/or received data complies with established standards.

CatSW® Monitor: Monitors and manages the operation of installed modules, generates console alerts, email and/or SMS notifications. Monitors TCP connections, automatically restarts ports and services for configured modules.

CatSW® HSM: Manages the security and encryption elements necessary to establish the various connections or messaging exchanges. It connects to the HSM for key exchange, for the various PIN translate operations, to validate the PIN - CVC - EMV, to validate the ARQC, and to generate the ARPC.

CatSW® Admin: System administration web interface that manages profiles synchronized with Power IBM i users and user groups, allows parameterization of tables and other system configurations. It allows viewing of transactional graphs and audit logs, and also queries and report generation.

CatSW® Authorizer: Connects to the Core Banking system, sends transactions with all the corresponding messaging and validations for authorization or rejection, as applicable. It exchanges ISO administrative messages (0800), ISO transactional messages, and ISO reversal messages (0200 and 0420). It generates user-customized reports displayed in CatSW® Admin.

CatSW® Stand-in: Authorizes the transactions according to the product settings.

CatSW® POS: Validates security elements, sends the transaction to the Banking Core for authorization, generates reconciliation. Sends and/or receives files via FTP or SFTP. Allows transactional graphical queries, queries, and reports on the web interface.

CatSW® ATM: Console interface via Power IBM i or web environment that allows ATM administration and control, online ATM monitoring, command sending, NDC (NCR) and 912 (Diebold) messaging management and support, and ATM download or image development and configuration (states and screens). It has the ability to handle different download versions on ATMs and generate dispensing algorithms through a web interface. It allows online EDC or ATM Journal registration and consultation, transactional graphic consultation, queries, and reports through a web interface.

CatSW® Mobile Payment: Enables connection to P2P, P2C, and C2P services on the network, exchange of ISO administrative messages (0800), exchange of ISO transactional and reverse messages (0200 and 0420) for each of the Mobile Payment channels, sending transactions to the Banking Core for authorization, installing P2P, P2C, and C2P services for consumption or use of external Bank applications, generating user-tailored reports displayed in CatSW® Admin, and generating files for reconciliation.